Tom was such a dedicated, hard working and incredible lawyer! He was available for any questions, concerns or follow ups we had at any hour day or night. Tom was very thorough and helped make this...

Thomas W Bauer, ESQ, CPA

(6)

Photos

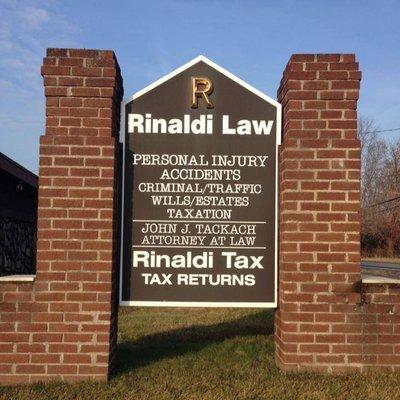

Also at this address

Reviews

I'm going through some hard financial times and called Thomas. He returned my call immediately and spent about 20 mins on phone with me. Felt like I was speaking to a friend. His guidance &...

I only wish I came to Thomas sooner! Happened to find this gentleman after reviewing numerous attorneys via Google for my specific real estate situation. All of the positive reviews are spot on:...

Very personable and reasonable. Explains everything throughly and walks you through any process he's handling for you. Highly recommend and would use again without a second thought.

I hired Tom to help me with a difficult financial issue while dealing with a serious health issue. He is kind, caring, thorough, non-judgemental and knows his stuff! I would highly recommend him...

You might also like

Partial Data by Foursquare.